Silicon Valley has long been the heart of venture capital. However, the industry has transformed. Now, it’s global. Venture capital is no longer limited to California. It’s spread worldwide. From the startup scenes of China and India to Europe. This shift has changed the innovation landscape. It fosters diversity, democratizes access to funding, and allows entrepreneurs from all backgrounds to compete globally.

The Rise of New Venture Capital Hubs

Silicon Valley used to be the center of venture capital. It funded companies like Google, Facebook, and Apple. While still powerful, other regions have emerged. Here are some examples:

- China: Venture capital is booming here. The massive consumer market and government support fuel this.

- India: The digital economy is growing fast. Investments in fintech, e-commerce, and edtech are surging.

- Europe: Venture capital is rising in cities like London, Berlin, and Paris. Startups in fintech, healthtech, and green energy thrive.

This global expansion leads to diverse innovations. Entrepreneurs from various backgrounds bring unique ideas.

Democratizing Access to Funding

The globalization of venture capital democratizes access to funding. Entrepreneurs outside major tech hubs now have better chances. Venture capital firms look beyond traditional markets. They invest in founders from emerging economies and underrepresented communities.

For example, startups in Africa, Southeast Asia, and Latin America attract significant capital. These investments drive local innovation and address unique challenges. Financial inclusion, affordable healthcare, and sustainable agriculture are key areas.

This democratization levels the playing field. Entrepreneurs in remote regions can now compete with Silicon Valley. It also fosters an inclusive innovation ecosystem.

The Impact on Global Innovation

Global venture capital has transformed global innovation. By funding diverse startups, venture capitalists enable local solutions. They also create technologies with global applications. For instance:

- China: Drone tech and electric vehicles.

- India: Food delivery, ride-hailing and electric mobility.

These innovations improve lives and shape industries worldwide. Global venture capital also fosters cross-border collaboration. Startups partner with multinational corporations, research institutions, and other innovators.

The Global Budget of Venture Capital

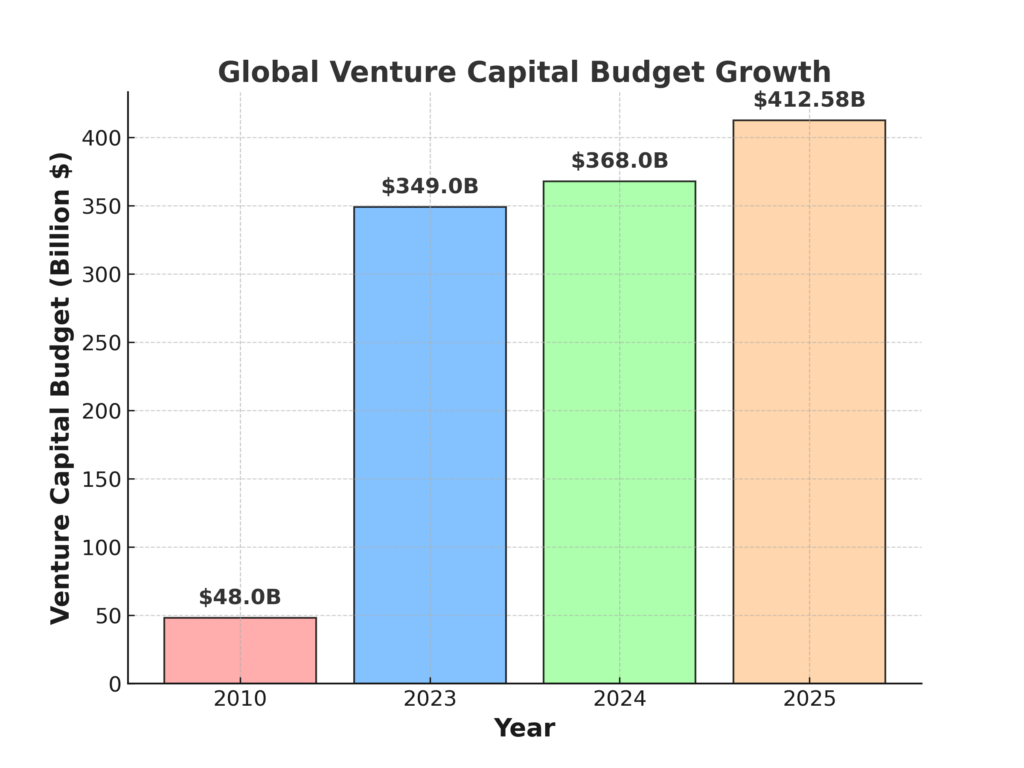

The global venture capital budget has seen significant growth over the years. In 2024, the global venture capital funding reached approximately $368 billion. This marked a 5% increase from $349 billion in 20231. Looking back, the venture capital budget was much smaller. For instance, in 2010, the global venture capital investments were around $48 billion.

Looking ahead, the future of venture capital funding appears promising. It is projected that the global venture capital market will grow from $373.37 billion in 2024 to $412.58 billion in 2025, at a compound annual growth rate (CAGR) of 10.5%. This growth can be attributed to favorable economic conditions, high demand for new products and services, successful exits, globalization, and supportive government policies.

Challenges and Opportunities

Global venture capital brings benefits but also challenges. Regulatory differences, currency fluctuations, and geopolitical risks complicate investments. Venture capitalists must navigate cultural nuances and market dynamics.

However, challenges create opportunities. Diverse, global teams can better support founders. Partnerships with local investors and accelerators help bridge gaps and foster success.

Looking Ahead

Venture capital will continue to globalize. More funding will flow to emerging markets and underrepresented founders. New technologies like AI, blockchain, and renewable energy will drive innovation. Impact investing will also expand the industry’s reach.

In summary, global venture capital reshapes innovation. It fosters diversity and empowers entrepreneurs worldwide. By breaking down barriers, venture capital creates a more connected, innovative, and equitable world.

This blog post was written with the assistance of Apple Intelligence, Grok 3, Copilot and ChatGPT, based on ideas and insights from Edgar Khachatryan. Photos by Author and AI.